Are you having trouble finding 'how to write a covered call order'? You will find your answers right here.

Table of contents

- How to write a covered call order in 2021

- What is a covered call example

- Fidelity covered call tutorial

- Sell to open covered call

- How to write covered calls td ameritrade

- Best stocks for covered call writing

- Covered calls for dummies

- Covered options explained

How to write a covered call order in 2021

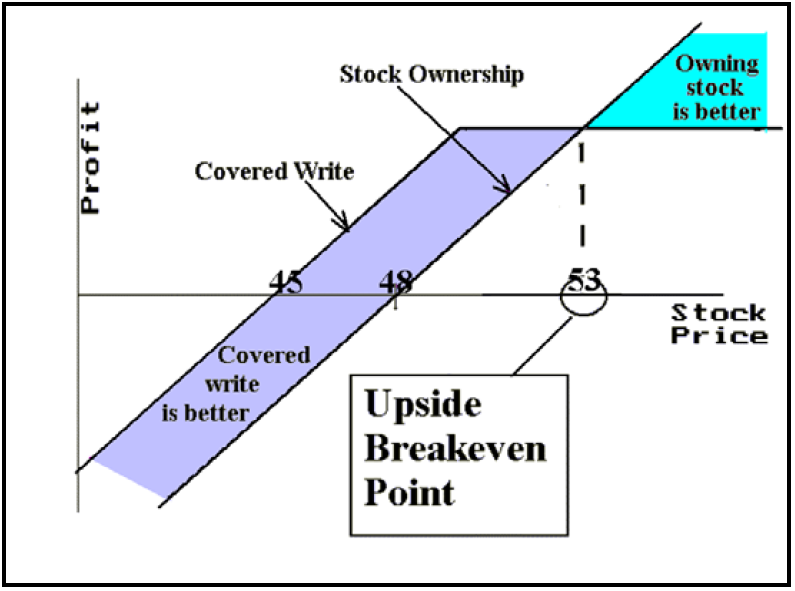

This picture demonstrates how to write a covered call order.

This picture demonstrates how to write a covered call order.

What is a covered call example

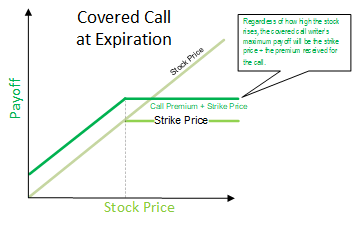

This picture illustrates What is a covered call example.

This picture illustrates What is a covered call example.

Fidelity covered call tutorial

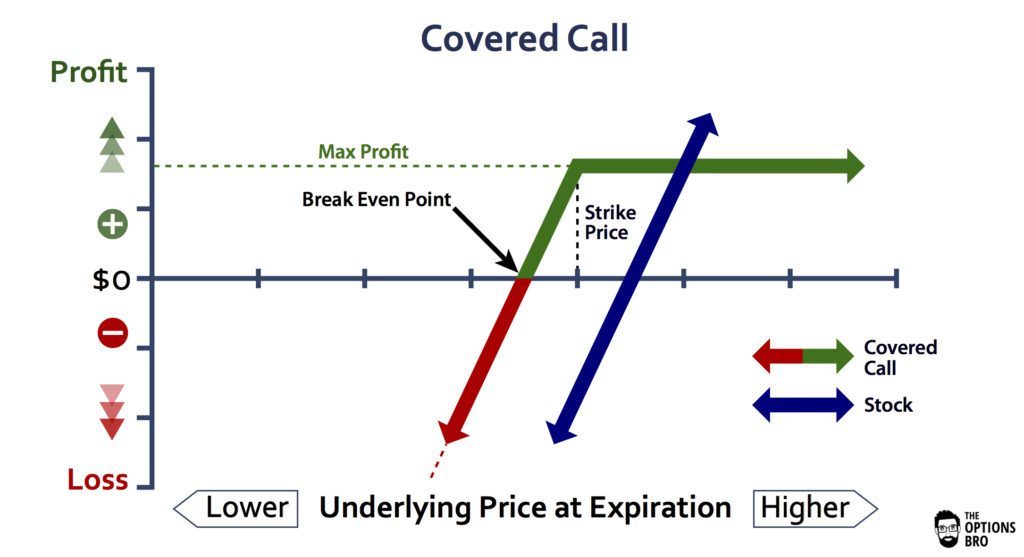

This image shows Fidelity covered call tutorial.

This image shows Fidelity covered call tutorial.

Sell to open covered call

This image representes Sell to open covered call.

This image representes Sell to open covered call.

How to write covered calls td ameritrade

This picture representes How to write covered calls td ameritrade.

This picture representes How to write covered calls td ameritrade.

Best stocks for covered call writing

This image illustrates Best stocks for covered call writing.

This image illustrates Best stocks for covered call writing.

Covered calls for dummies

This picture representes Covered calls for dummies.

This picture representes Covered calls for dummies.

Covered options explained

This image demonstrates Covered options explained.

This image demonstrates Covered options explained.

How are covered calls used in the stock market?

A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. A covered call is constructed by holding a long position in a stock and then selling (writing) call options on that same asset, representing the same size as the underlying long position.

How to calculate strike price for covered calls?

Click here to see a bigger image. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. Price: This is the price that the option has been selling for recently. This is basically how much the option buyer pays the option seller for the option.

How many shares do you have to own to write a covered call?

Because one option contract usually represents 100 shares, to run this strategy, you must own at least 100 shares for every call contract you plan to sell. As a result of selling (“writing”) the call, you’ll pocket the premium right off the bat.

What happens when you write a covered call?

As a result of selling (“writing”) the call, you’ll pocket the premium right off the bat. The fact that you already own the stock means you’re covered if the stock price rises past the strike price and the call options are assigned. You’ll simply deliver stock you already own, reaping the additional benefit of the uptick on the stock.

Last Update: Oct 2021