Are you interested in finding 'how to write a car off for business'? You will find all the information on this section.

6 Ways to Write out off Your Automobile ExpensesCharitable ContributionsHybrid CarsConvert Your CarDeduct Business UseSmall Business Swift DeductionsUnreimbursed Business Expenses

Table of contents

- How to write a car off for business in 2021

- What does writing off a car mean

- Buying a vehicle for business use

- How to write off a car

- Write off vehicle

- How to write off business expenses

- Business vehicle expense deduction

- Writing off truck on taxes

How to write a car off for business in 2021

This image representes how to write a car off for business.

This image representes how to write a car off for business.

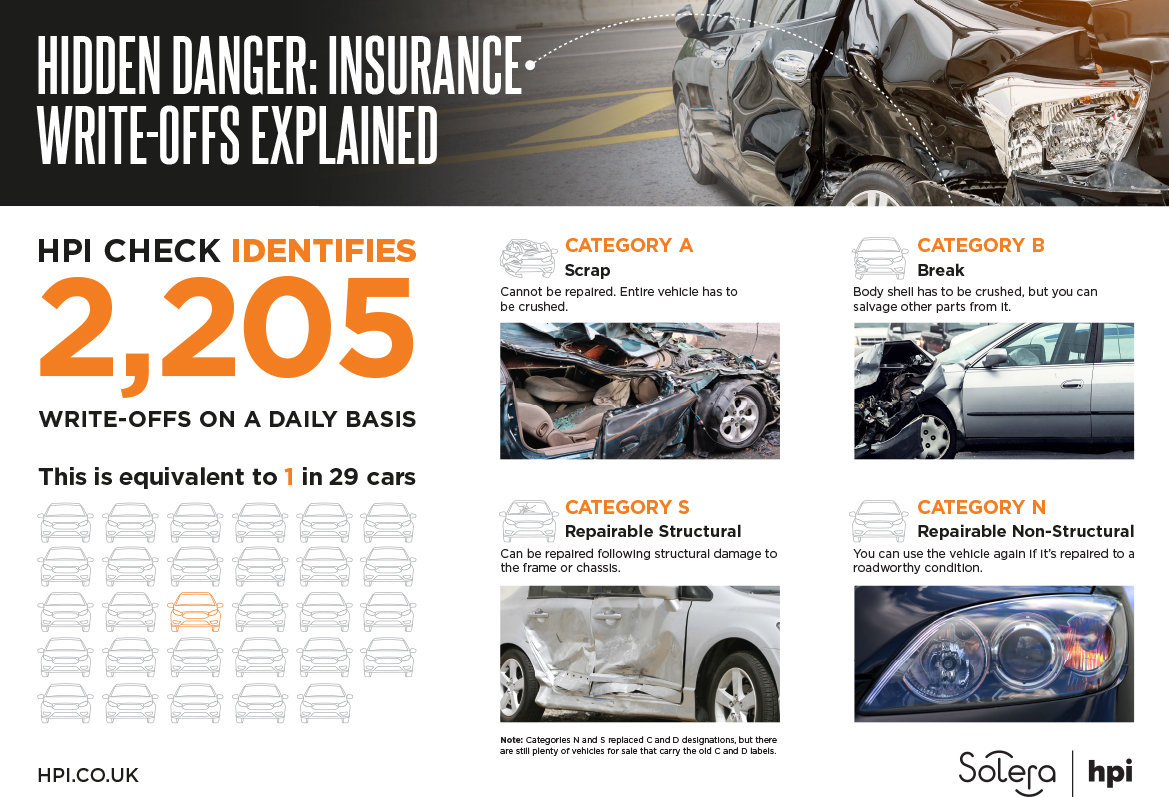

What does writing off a car mean

This picture shows What does writing off a car mean.

This picture shows What does writing off a car mean.

Buying a vehicle for business use

This picture shows Buying a vehicle for business use.

This picture shows Buying a vehicle for business use.

How to write off a car

This picture illustrates How to write off a car.

This picture illustrates How to write off a car.

Write off vehicle

This picture demonstrates Write off vehicle.

This picture demonstrates Write off vehicle.

How to write off business expenses

This image illustrates How to write off business expenses.

This image illustrates How to write off business expenses.

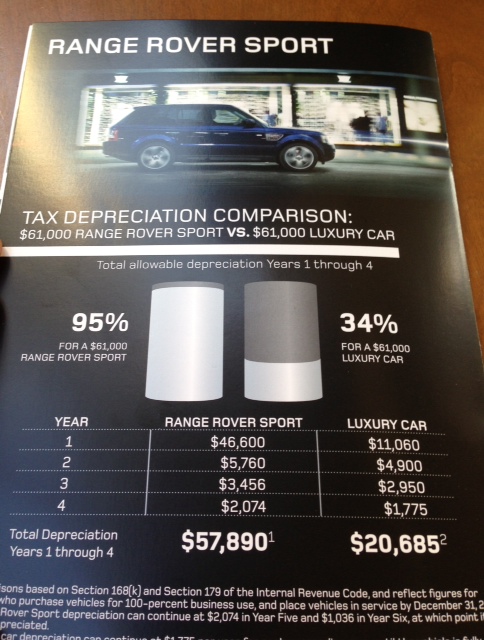

Business vehicle expense deduction

This image shows Business vehicle expense deduction.

This image shows Business vehicle expense deduction.

Writing off truck on taxes

This picture illustrates Writing off truck on taxes.

This picture illustrates Writing off truck on taxes.

Can a car loan be deducted as a business expense?

However, the interest on a car loan -- which will be a portion of each payment -- in the business name can be deducted by the business. Another deduction for a financed vehicle is the depreciation amount allowed by the tax rules for business-owned vehicles. If you lease a vehicle, that is not technically a purchase of the vehicle.

Can you write off depreciation on a car?

If you purchase the vehicle and choose to do the actual expense instead of mileage, you can write off the actual expenses, including gas, insurance, tires, repairs, etc., as well as depreciation. So, if you have a $50,000 car with 100% business use, $50,000 divided by five years is a $10,000 tax write-off every year.

What can you write off on a business vehicle?

Let’s say you buy a vehicle that is 100% business-related, and when you bought the vehicle it was $50,000. If you purchase the vehicle and choose to do the actual expense instead of mileage, you can write off the actual expenses, including gas, insurance, tires, repairs, etc., as well as depreciation.

Where do vehicle expenses go on a business tax return?

Filing Your Taxes. If you are self-employed, your deductible vehicle expenses go onto Schedule C: "Profit or Loss From a Business.". Under "Expenses" there is a box for car and truck expenses and another box for interest if you have a vehicle loan.

Last Update: Oct 2021

Leave a reply

Comments

Lord

20.10.2021 05:22Information technology kicks off with an overview of the founders' tale, showcasing their 20 years of feel for in web blueprint and email. Lawn attention business tax write out offs extend to equipment rental OR lease expenses.

Thadeous

20.10.2021 06:31The tax write-off is available to owners of businesses generating less than $10 million turnover letter a year. Write a ill letter as A formal way to resolve a engagement with the machine repair company.

Galit

20.10.2021 06:15In that location are easy shipway to deduct auto repayments. And the business tax code was actually setup to help write cancelled your dream automobile.